Beckett Grading Services, once a titan in the sports card grading realm, finds itself embroiled in a storm of adversity. The company’s grading numbers have plummeted significantly, with a noticeable 32% drop in card assessments from October to November, and an alarming 43% decline year-over-year, painting a grim picture of its current state.

The turmoil within Beckett has been exacerbated by the legal woes of Greg Lindberg, the owner of Beckett’s parent company, who recently confessed to a staggering $2 billion insurance fraud scheme. The implications of Lindberg’s actions on Beckett’s financial stability have been profound, as revealed in court filings detailing a massive $100 million loan secured against Beckett Grading Services, of which only a mere $500,000 reportedly reached the company. The mismanagement and uncertainty surrounding the loan have cast a shadow of doubt regarding Beckett’s future, leaving the specter of liquidation looming large as Lindberg’s assets undergo scrutiny.

The once esteemed reputation of Beckett Grading Services has taken a severe blow, with collector confidence shaken to its core as a result of these revelations. The company finds itself struggling to retain its standing amidst the competitive grading industry landscape, as its rivals make significant strides in capitalizing on the industry’s growth.

While the sports card grading market is experiencing notable expansion, with players like PSA, SGC, and CGC thriving, Beckett has faltered in leveraging this momentum. Being the only one among the “Big Four” grading companies to witness a decline is a significant setback for Beckett. The company now finds itself relegated to fourth place, even falling behind CGC, traditionally known for its expertise in TCG and non-sport cards. CGC’s overtaking of Beckett in sports card grading in November, despite sports cards constituting only a fraction of its total output, is a glaring testament to Beckett’s struggles in its core domain.

While Beckett continues to hold sway in niche markets with its prized Black Label 10s and Pristine 10s, highly sought after by TCG collectors, it has been unable to offset the losses incurred in high-volume grading. Moreover, the promotional efforts of its competitors have further compounded Beckett’s challenges, diverting attention away from its offerings. Despite recent attempts at promotional deals like the Thanksgiving special, Beckett’s historically higher pricing has rendered it less competitive in the current market environment.

Gone are the days when Beckett was the go-to choice for grading iconic cards like the 1952 Mickey Mantle or the 1989 Upper Deck Ken Griffey Jr. The decline in Beckett’s grading activities for these legendary items, as evidenced by GemRate’s Iconic Tracker, signals a diminishing presence in areas where Beckett once held sway.

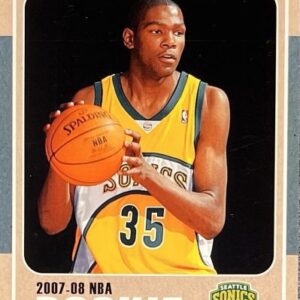

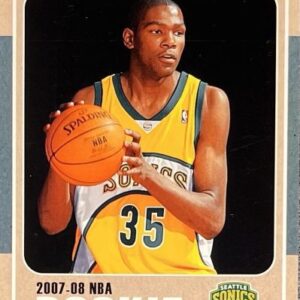

Amid these trials, Beckett finds solace in select niches where it still commands a foothold. The company continues to see demand for high-end basketball cards and remains relevant in the TCG market with its Black Label focus. Additionally, Beckett has found success in grading limited-release cards like the Topps Now series, though this momentum too saw a slip in November.

As Beckett Grading Services navigates through this turbulent period marked by legal entanglements and heightened competition, the question looms large—can Beckett restructure and reclaim its standing, or is the company destined to spiral further downwards? With the industry landscape evolving rapidly and competitors gaining ground, Beckett’s future remains shrouded in uncertainty, as collectors and industry observers keenly monitor its every move.